Best Describes What the Annuity Period Is

It has the following characteristics. Instead the contract holder will have nonforfeiture options or rights to cash value accumulation in the annuity.

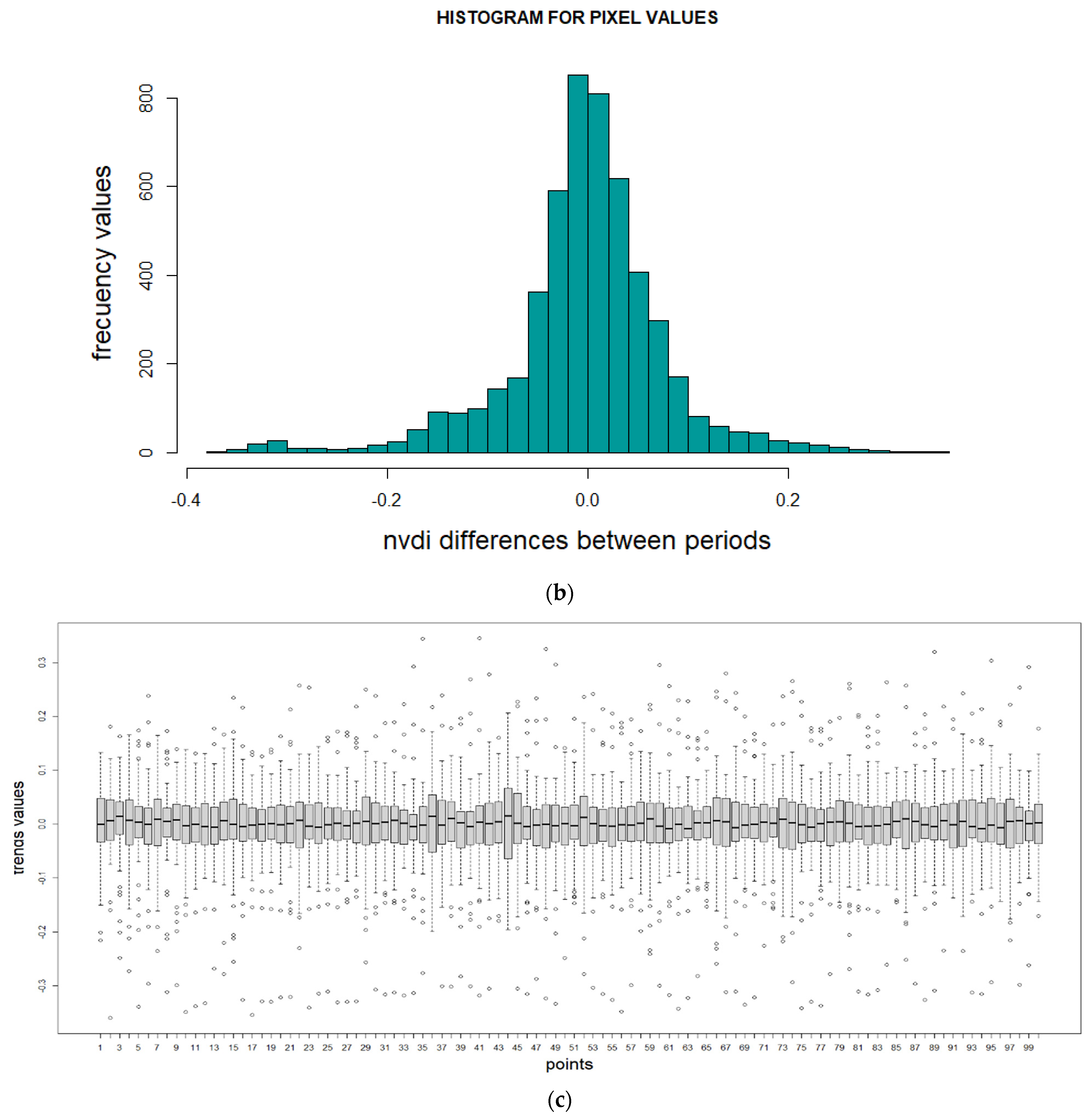

Remote Sensing Free Full Text Multi Temporal Sentinel 2 Data Analysis For Smallholding Forest Cut Control Html

Either the amount paid into the plan or the cash value of the plan whichever is the greater amount Term.

. The accumulation phase is the pay-in period during which premiums are paid into the annuity. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments. Annuities are characterized by how they can be paid for.

Also which is more valuable ordinary. A regular annuity is a regular payment at the end of each period that. You pay a set amount of money today or over time in exchange for a lump-sum payment or stream of income in the future.

Which of the following best describes what the annuity period is. The period of time during which money is accumulated in an annuity. Annuities provide guaranteed income for life by systematically liquidating the sum of money that has accumulated in the annuity.

D The period of time spanning from the effective date of the contract to the date of its. The period of time from the accumulation period to the annuitization period 4. All payments are in the same amount such as a series of payments of 500.

A lifetime annuity is an annuity that is purchased with a payout period that will in most cases give a predictable payment each month for the lifetime of the annuitant the individual whose life. A The period of time spanning from the accumulation period to the annuitization period b The period of time during which money is accumulated in an annuity c The period of time spanning from the effective date of the contract to the date of its termination. The final alternative is a hedge against the early death of a retiree and spouse.

Periodic payment annuities can be either level in which the annuitantowner pays a fixed installment or the payments can be flexible in which the amount and frequency of each. For an annuity the accumulation period is the segment of time in which contributions to the investment are made regularly. In a growing annuity due payments or receipts occur at the beginning of each period.

The length of the accumulation period may be specified at the time the account is created or it may depend on when you elect to withdraw funds based on your retirement timeline. The annuity period is. An annuity is a series of payments made at equal intervals.

In an annuity the accumulated money is converted into a stream of income during which time period. Which of the following best describes the accumulation phase of an annuity. The type of annuity and the details of the particular annuity can determine.

An annuity due is a repeating payment that is made at the beginning of each period such as a rent payment. The period of time during which accumulated money is converted into income payments 3. C The period of time during which money is accumulated in an annuity.

B The period of time spanning from the accumulation period to the annuitization period. Fines of up to 1000 for each act. Period of time during which money is accumulated in an annuity D.

Certain groups of employees only such as public educators. In a growing ordinary annuity payments or receipts occur at the end of each period. Violation of unfair discrimination law may result in all of the following penalties EXCEPT.

A series of payments or receipts occurring over a specified number of periods that increase each period at a constant percentage. A lucky individual won the state lottery so the state will be sending him a check each month for the next 25 years. A term deferred annuity is one that eventually turns your balance into a set number of payments like over five years or.

The time during which accumulated money is converted into an income stream. Term Deferred Annuities. An annuity which provides for payments for the remainder of a persons lifetime is a life annuity.

Which of the following best describes what the annuity period is. A The period of time during which accumulated money is converted into income payments b The period of time spanning from the accumulation period to the annuitization period c The period of time during which money is accumulated in an annuity d The period of time spanning from the effective date of. Any person willfully engaging in an unfair method of competition may be liable for a fine of up to.

Secondly how is an annuity paid out. Period of time from the accumulation period to the annuitization period C. In the alternatives previously explored benefits end upon the death of the retiree and spouse regardless of how short or long a period of time they are received.

The term annuity due is used to describe a monthly payment that increases by the same amount each month. A periodic annuity is a payment or receipt of a fixed amount of money each period. Your client plans to.

A The period of time during which accumulated money is converted into income payments. It would not occur in a deferred annuity. The period of time from the effective date of the contract to the date of its termination 2.

In a period certain annuity such as a 10-year certain annuity. Annuities are essentially insurance contracts. Period during which accumulated money is converted into income B.

An annuity is defined as the liquidation of a principal sum to be distributed on a periodic payment basis to begin at a specified time and continue for a specified period of time or for the duration of a designated life or lives. Period of time from effective date of contract to the date of its termination. A tax sheltered annuity is a special tax-favored retirement plan available to.

Which of the following best describes what the annuity period is. All payments are made at the same intervals of time such as once a month or year. Which of the following best describes what the annuity period is.

It is the period over which the annuitant makes payments into an annuity. During the accumulation period an annuity contract owner who stops paying premiums does not lose the money invested in the annuity. Either a single payment lump sum or through periodic payments in which the premiums are paid in installments over a period of time.

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization.

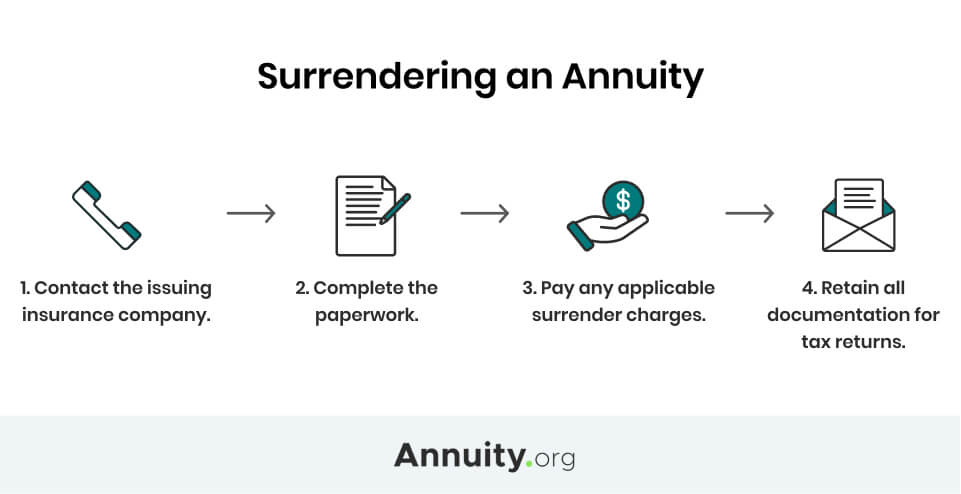

Surrendering An Annuity Annuity Surrender Charges

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis

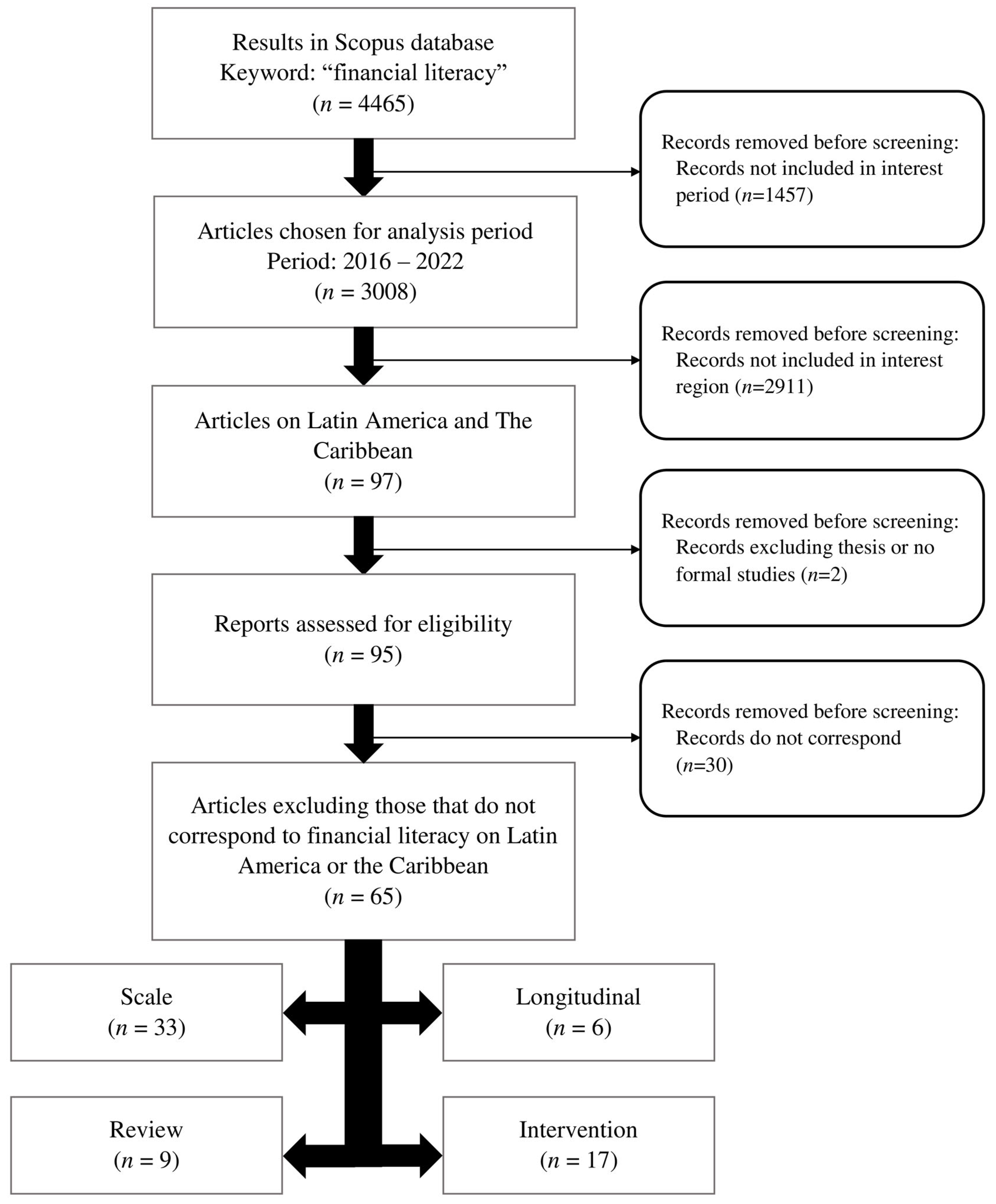

Sustainability Free Full Text A Systematic Review Of Financial Literacy Research In Latin America And The Caribbean Html

/dotdash-whats-difference-between-grace-period-and-moratorium-period-Final-4c9b5aa8055a4fdeb130db04c26f3e91.jpg)

Grace Period Vs Moratorium Period

The Life Care Annuity A New Empirical Examination Of An Insurance Innovation That Addresses Problems In The Markets For Life Annuities And Long Term Care Insurance Brown 2013 Journal Of

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-moratorium-period-Final-4c9b5aa8055a4fdeb130db04c26f3e91.jpg)

Grace Period Vs Moratorium Period

On The Feasibility Of Reverse Mortgages In Colombia Emerald Insight

Annuity Payout Options Immediate Vs Deferred Annuities

People S Dumbest High Risk Low Reward Moments Dumb And Dumber High Risk Not Having Kids

Immc Swd 282021 29611 20final Eng Xhtml 4 En Impact Assessment Part1 V6 Docx

Risks Free Full Text The Impact Of Health Impairment On Optimal Annuitization For Retirees Html

How To Calculate The Future Value Of An Ordinary Annuity Youtube

People S Dumbest High Risk Low Reward Moments Dumb And Dumber High Risk Not Having Kids

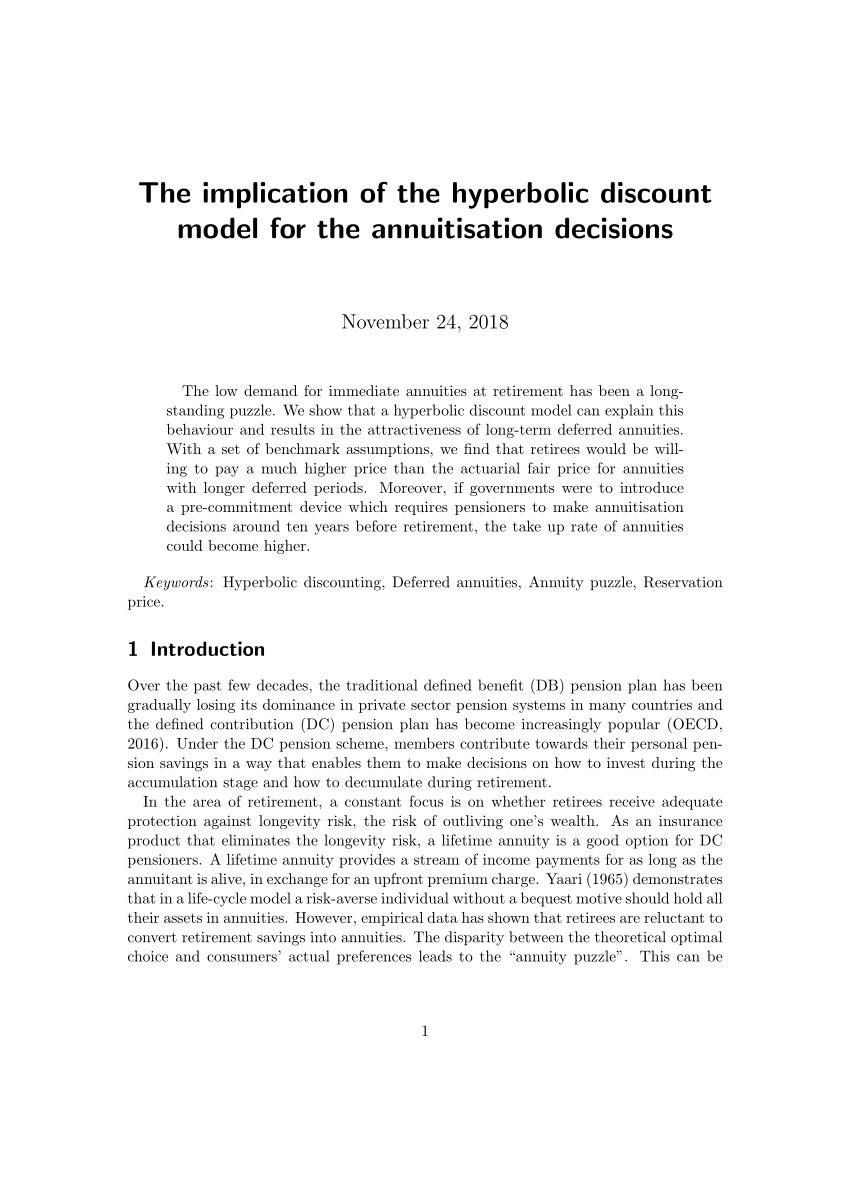

Pdf Why The Deferred Annuity Makes Sense

Period Certain Annuity What It Is Benefits And Drawbacks

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Comments

Post a Comment